A proposed $2,000 federal direct deposit planned for February 2026 has attracted strong public attention. Many households are trying to understand whether the payment is real, who may qualify, and how the money would be delivered. Large federal payments usually follow strict rules, so it is important to understand the process clearly before making financial plans based on expectations.

What Is Known About the February 2026 Payment

Based on policy discussions and documents linked to late-2025 announcements, the payment is not designed for every individual in the country. The Internal Revenue Service and other federal agencies typically distribute relief-style payments only after eligibility rules are defined. This proposed $2,000 amount appears targeted toward specific income groups and benefit recipients rather than being a universal payment for all adults.

Who May Be Considered Eligible

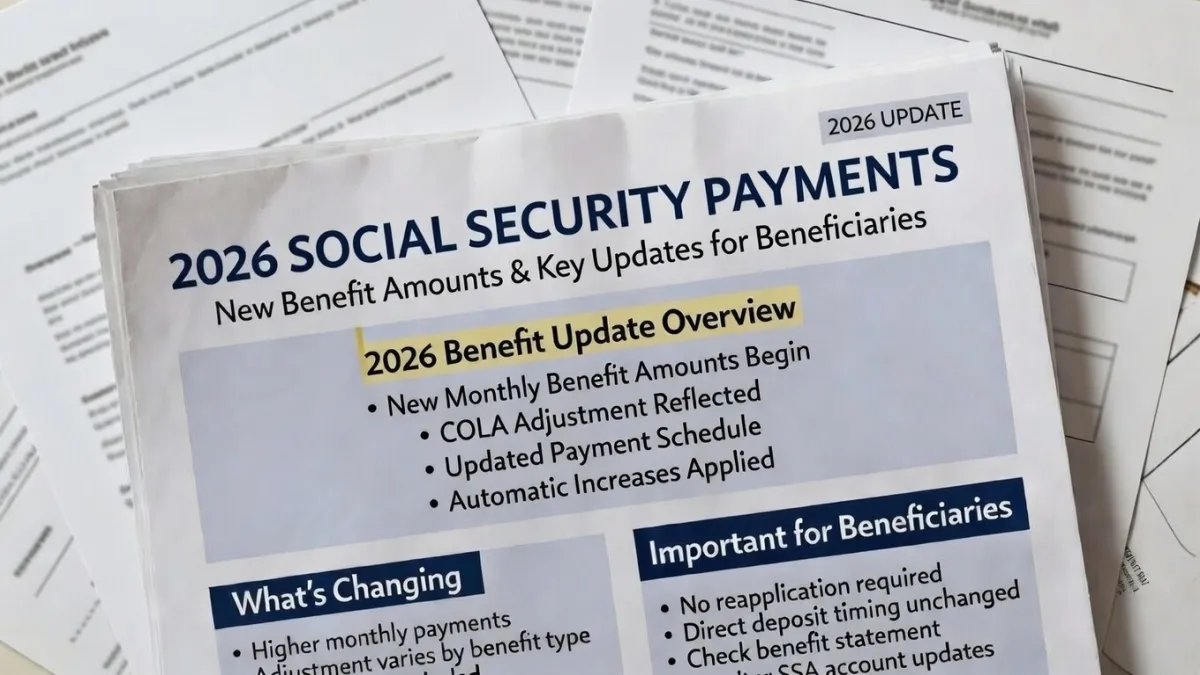

Eligibility is expected to depend mainly on income level, household size, and participation in certain federal benefit programs. Individuals receiving benefits through the Social Security Administration, including retirement, disability, or supplemental income support, may be included automatically if their records meet program conditions. However, higher income earners could face reductions or complete exclusion due to income limits.

Role of Tax Filing and Personal Records

Tax filing history often plays a major role in determining eligibility. Agencies usually rely on the most recent completed tax return to confirm income and dependent information. Those who filed their 2024 tax return accurately and on time may experience fewer delays. Changes in marital status, dependents, or address details can affect verification and timing.

How and When Payments May Be Issued

Federal agencies generally release payments in stages rather than on a single nationwide date. Direct deposits are expected to begin in early February 2026 and continue throughout the month. Individuals already enrolled in electronic payment systems usually receive funds first. Paper checks and prepaid debit cards may follow weeks later, depending on processing capacity.

Importance of Updated Bank Information

Outdated or incorrect banking details are one of the most common causes of delayed or rejected payments. Beneficiaries are strongly encouraged to review and update direct deposit information through official government portals. Closed accounts or incorrect routing numbers can result in funds being returned and reissued later by mail.

Avoiding Scams and False Claims

Large federal payments often attract scam attempts. Official agencies do not request banking passwords, verification fees, or personal details through unsolicited messages. Payment status should only be checked through verified government websites or official correspondence.

Final Understanding

The proposed February 2026 $2,000 federal direct deposit is not guaranteed for everyone. Eligibility depends on income, benefit enrollment, and accurate records. Confirming information early and relying only on official sources helps reduce confusion and financial uncertainty.

Disclaimer: This article is for informational purposes only and does not constitute financial, legal, or tax advice. Eligibility rules, payment timing, and final approval depend on official government decisions and individual circumstances. Readers should verify details through authorized federal agency portals or consult qualified professionals before making financial decisions.