February 2026 is an important month for millions of Americans who depend on Social Security retirement and SSDI disability benefits. For many households, these monthly payments cover essential expenses such as rent, food, utilities, and medical needs. Knowing when payments will arrive and understanding why the amount may look different helps beneficiaries plan their budgets with more confidence and less stress.

How the February 2026 Payment Schedule Works

Social Security and SSDI benefits follow a fixed monthly schedule set by the Social Security Administration. Payments are not sent to everyone on the same day. The exact date depends mainly on when a person first started receiving benefits and their date of birth.

People who began receiving Social Security benefits before May 1997 are usually paid at the start of each month. Their payment date does not depend on their birthday, and they often receive their deposit earlier than others. This older rule still applies in February 2026.

Those who started receiving benefits after May 1997 are paid based on their birth date. People born earlier in the month receive payments earlier, while those born later receive them later. SSDI payments generally follow this same birth-date-based system.

SSI and SSDI Payments Together

Some beneficiaries receive both SSDI and Supplemental Security Income. In these cases, payment timing can seem confusing. SSI is normally paid at the beginning of the month, while SSDI follows the birthday schedule. This means two separate deposits may arrive on different days. This is normal and usually not a problem.

COLA Increase and Benefit Amount Changes

Benefit amounts are adjusted each year through a Cost of Living Adjustment, known as COLA. The 2026 COLA increase started with January payments, so February deposits already reflect this higher rate. COLA is applied as a percentage, so people with higher base benefits see a larger dollar increase than those with smaller benefits.

However, the final amount deposited may not match expectations. Deductions such as Medicare Part B premiums are often taken out automatically. If these premiums rise, the net increase after COLA may feel smaller. This is common and not a mistake.

Avoiding Misinformation and Staying Safe

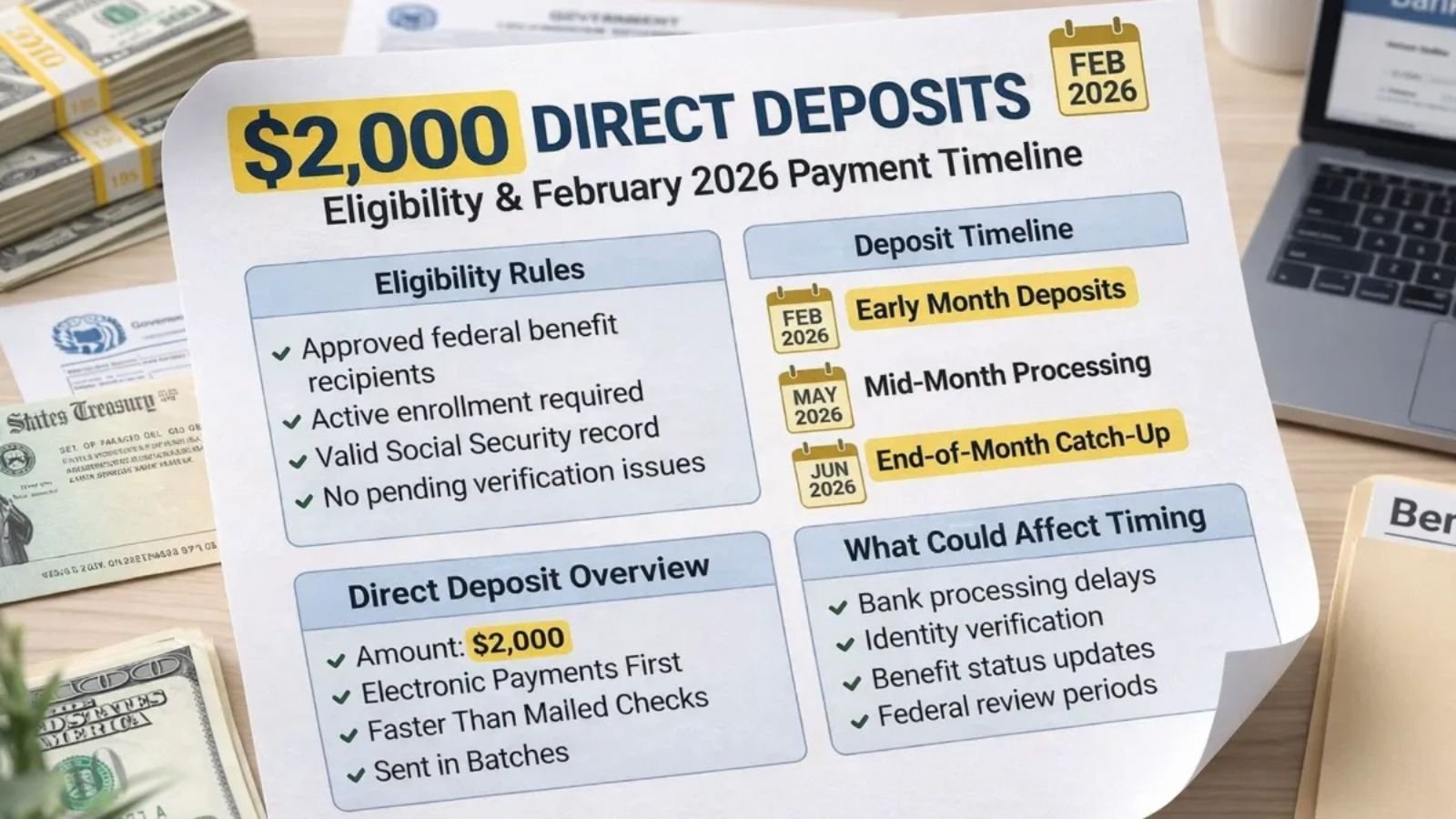

There has been online talk about new stimulus payments in 2026, but there is no officially approved nationwide stimulus scheduled for February 2026. People should be cautious of social media posts promising surprise deposits. Official announcements are always the safest source.

Scams also increase around payment dates. Government agencies do not ask for personal or banking information through unexpected calls, texts, or emails. When in doubt, beneficiaries should check their official online account or contact verified offices directly.

Understanding the February 2026 payment schedule, COLA adjustments, and deductions makes financial planning easier and helps avoid unnecessary worry.

Disclaimer:

This article is for general informational purposes only and is not financial, legal, or benefits advice. Payment dates, benefit amounts, deductions, and eligibility rules depend on individual records and official government policies. Always verify your personal benefit details through your official Social Security account or authorized government representatives.