The first Social Security payments of 2026 are set to arrive next week, and millions of beneficiaries are closely watching their bank accounts. For retirees and people receiving disability benefits, these monthly payments are a primary source of income. With a new cost of living adjustment now in effect and possible changes to Medicare premiums, even small differences in payment amounts can affect how households manage their monthly budgets.

How the Social Security Payment Schedule Works

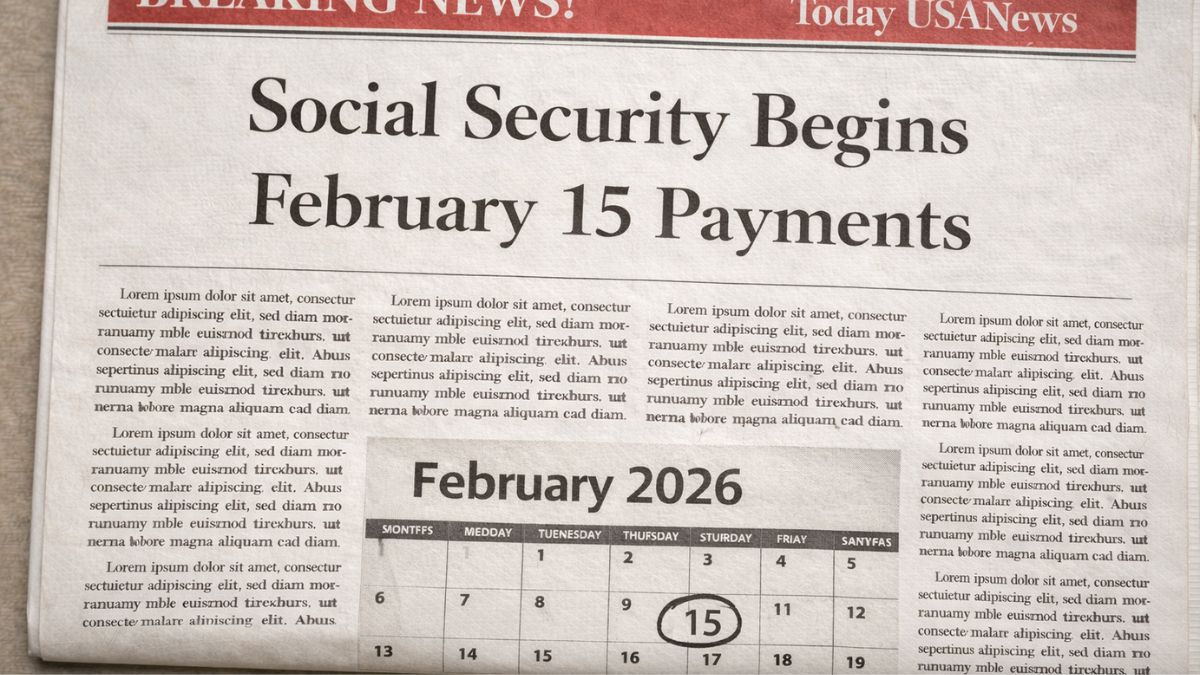

The Social Security Administration follows a structured payment system each month. People who started receiving Social Security benefits before May 1997 are usually paid at the beginning of the month. Their payment date does not depend on their birthday and remains consistent throughout the year.

Beneficiaries who began receiving benefits after May 1997 are paid based on their date of birth. Payments are issued on the second, third, or fourth Wednesday of the month. Those born early in the month are paid earlier, while those born later receive their payments later. Reviewing the official payment calendar helps confirm the exact deposit date and avoids unnecessary concern.

What the 2026 Cost of Living Adjustment Means

The 2026 cost of living adjustment has already been added to monthly Social Security payments. This annual increase is designed to help benefits keep up with rising prices for everyday goods and services. The adjustment is applied automatically, so beneficiaries do not need to submit any forms or requests.

Because the increase is percentage based, the dollar amount of the increase varies. People with higher monthly benefits will see a larger increase, while those with lower benefits will see a smaller change. Although the increase may seem modest, it can make a meaningful difference over the course of the year. Beneficiaries are encouraged to review their updated benefit notice to understand their new monthly amount.

How Medicare Premiums Affect Final Payments

While the total benefit amount may rise, the actual deposit can sometimes appear smaller than expected. Medicare Part B premiums are often deducted directly from Social Security payments. If Medicare premiums increase in 2026, part of the cost of living adjustment may be offset by higher deductions.

Comparing the gross benefit amount with the net deposit helps explain this difference. Understanding how deductions work can prevent confusion when the payment hits the bank account.

Preparing for the Year Ahead

At the start of 2026, beneficiaries should confirm their payment date and carefully review their benefit statement. Most people do not need to re-enroll, but any changes in income, work activity, or personal information should be reported promptly. Keeping records updated helps prevent delays or payment issues later in the year.

The first Social Security payment of 2026 sets the tone for monthly budgeting. Knowing how adjustments and deductions work together allows beneficiaries to plan their finances with greater confidence and stability.

Disclaimer:

This article is for informational purposes only and does not provide legal or financial advice. Payment amounts and deposit dates vary based on individual circumstances and official Social Security Administration policies. Always verify your personal benefit details through authorized government sources.