The announcement of a $2,000 direct deposit scheduled for February 17, 2026 has drawn strong attention from individuals and families across the United States. This payment, approved by the Internal Revenue Service, is intended to offer financial support during a time when many households are managing rising living costs. By using direct deposit instead of paper checks, the government aims to deliver the funds quickly and securely to eligible recipients.

Purpose of the $2,000 Direct Deposit

The February 2026 direct deposit is designed to provide short-term financial relief to qualifying Americans. Many households continue to face pressure from rent, food prices, healthcare expenses, and utility bills. This payment is meant to ease some of that burden by offering immediate support that can be used for essential needs. While it is not a long-term solution, it can help families stabilize their finances during a challenging period.

Who Is Expected to Qualify

Eligibility for the $2,000 payment depends on several important factors. Income level plays a major role, with the focus on individuals and families within specific income limits. Recent federal tax filings are also critical, as the IRS uses this information to review eligibility automatically. People who participate in certain federal assistance programs may have a higher chance of qualifying. Retirees, low- to middle-income households, and some benefit recipients are expected to be prioritized under current guidelines.

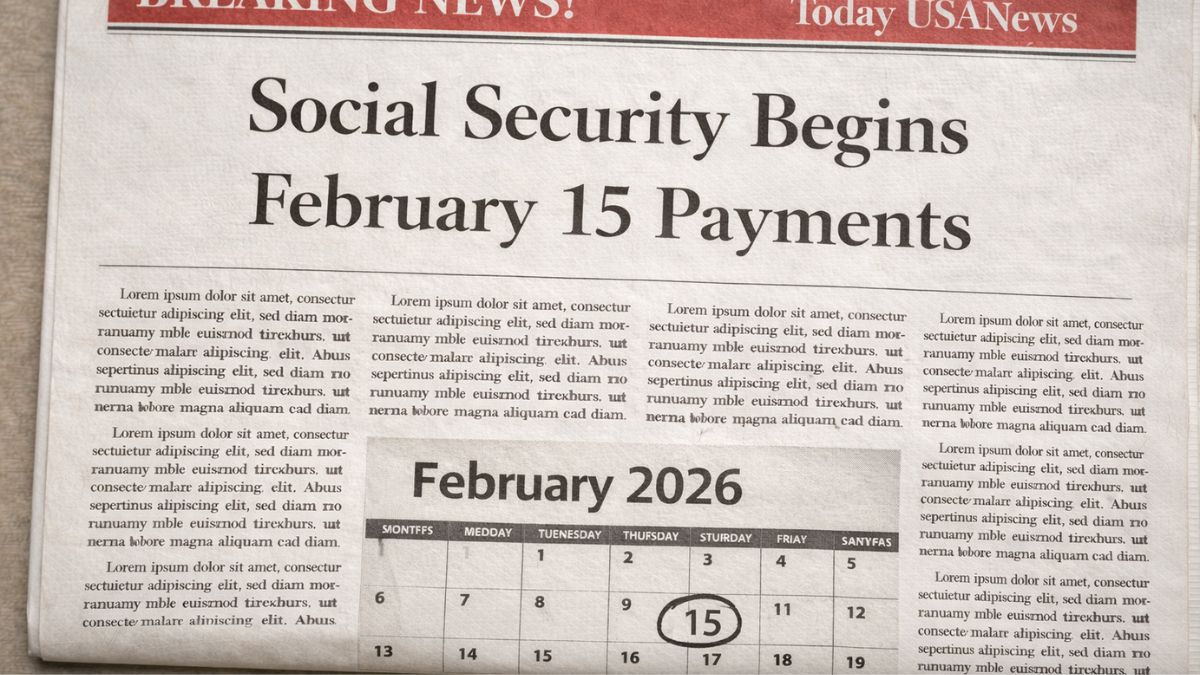

Payment Date and Deposit Process

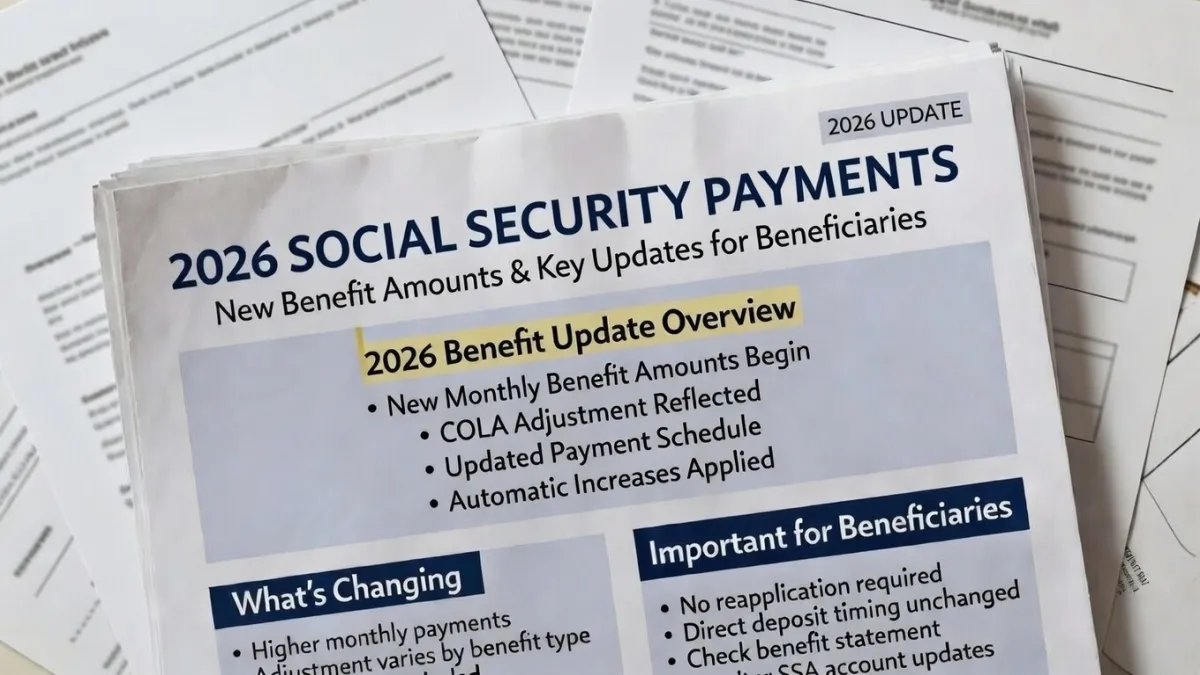

The payment is scheduled to be deposited on February 15, 2026. Individuals who already have valid direct deposit information on file with the IRS should receive the funds automatically without taking additional steps. It is very important that bank account and routing numbers are correct. Outdated or incorrect details can cause delays or result in the payment being returned. In most cases, recipients will receive a notification once the payment has been processed.

What Recipients Should Do

People expecting the deposit should monitor their bank accounts around the scheduled date. Reviewing official IRS communications can help confirm that the payment has been issued. It is also essential to remain cautious about scams. The IRS does not contact individuals through random emails, phone calls, or text messages asking for personal or banking information. Any such messages should be ignored.

Planning After Receiving the Payment

Some recipients may need to report the payment if it affects eligibility for other assistance programs. Checking program rules in advance can prevent issues later. Planning how to use the funds carefully, such as covering essential bills or reducing debt, can help make the most of this support.

The $2,000 direct deposit expected on February 17, 2026 is anticipated to provide meaningful relief for eligible Americans. Staying informed and keeping records updated will help ensure a smooth payment experience.

Disclaimer: This article is for informational purposes only. Payment amounts, eligibility rules, and deposit dates are subject to change based on official IRS and U.S. Treasury announcements. Readers should rely on verified government sources for the most accurate and up-to-date information.