As the 2026 tax season begins, millions of Americans are preparing to file their federal income tax returns for the 2025 tax year. For many households, a tax refund is not simply extra spending money. It often helps pay rent, school fees, insurance premiums, medical bills, or debt carried over from the holidays. Because refunds play such an important role in family budgets, understanding how the process works can help reduce confusion and set realistic expectations.

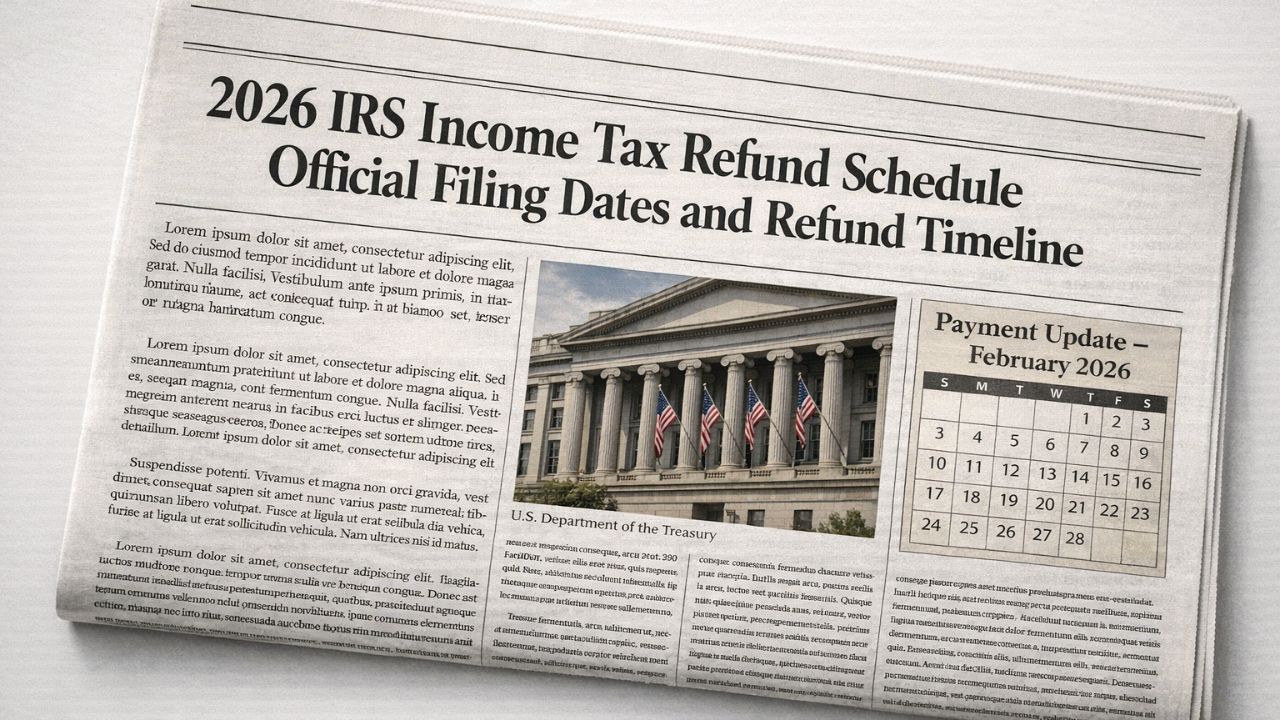

When the 2026 Filing Season Opens

The Internal Revenue Service is expected to begin accepting and processing tax returns in the final week of February 2026. While taxpayers may prepare their returns earlier using tax software or professional services, refunds cannot be issued until the IRS officially opens its systems. The regular filing deadline is February 15, 2026. Filing close to the deadline does not increase the refund amount and may slow processing due to heavy traffic during peak weeks.

Why Refund Dates Are Not Fixed

Unlike monthly government benefits, tax refunds do not follow a set national schedule. Each return is reviewed individually. The IRS does not publish a calendar listing exact refund dates because processing times vary. How quickly you receive your refund depends on the filing method, the accuracy of the information, and whether additional review is required.

Fastest Way to Receive a Refund

Electronic filing combined with direct deposit remains the quickest option. Many taxpayers who choose this method receive their refund within about twenty-one days after their return is accepted. However, this timeline is only an estimate. Paper returns usually take longer because they must be entered manually into the system. Requesting a mailed check instead of direct deposit also adds extra delivery time.

Common Reasons for Delays

Even early filers can face delays. Errors such as incorrect Social Security numbers, missing income documents, or mismatched employer records may trigger additional checks. These reviews help prevent fraud and protect taxpayer information. Returns that claim certain refundable credits, including income-based or child-related credits, are required by law to undergo extra review, which can delay payment until later in the season.

How to Track Your Refund

Taxpayers can monitor their refund status using the official IRS tracking tool. Updates typically appear within 24 hours after electronic filing. The system shows three stages: received, approved, and sent. Once marked as sent, banks may take one or two business days to post the funds.

Final Thoughts

Tax refunds are an essential part of many household financial plans. While exact payment dates cannot be guaranteed, filing electronically, choosing direct deposit, and carefully reviewing your information can improve your chances of receiving funds quickly and without complications.

Disclaimer: This article is for informational purposes only and does not provide tax, legal, or financial advice. IRS rules, timelines, and refund amounts may change and vary based on individual circumstances. For personalized guidance, consult official IRS resources or a qualified tax professional.