Tax season 2026 is now in full swing, and millions of Americans are waiting for their federal refunds. The timing of your deposit mainly depends on when you file your return and the method you choose. Understanding how the refund schedule works can help set realistic expectations and reduce stress during tax season.

How the 2026 IRS Refund Timeline Works

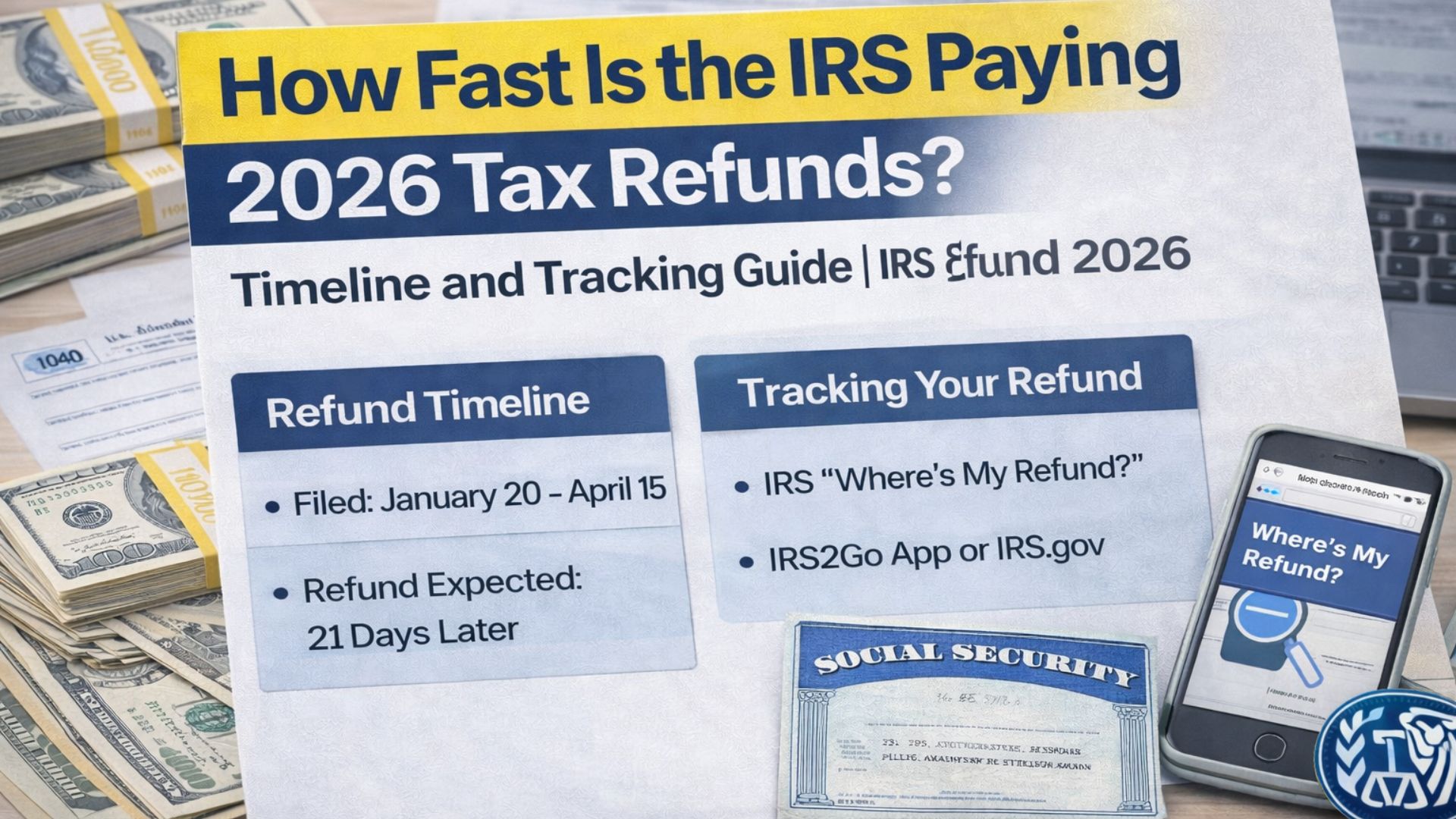

The Internal Revenue Service usually begins accepting federal tax returns in late January. Once your return is officially accepted, processing begins. For most taxpayers who file electronically and select direct deposit, refunds are generally issued within about 21 days. This is an average timeframe and not a guaranteed deadline.

Early filers who submit their returns in late January and are accepted quickly may receive their refunds by mid-February. Those who file in February often see deposits arriving in late February or early March. Taxpayers who file in March or April typically receive their refunds within three weeks of acceptance, although peak season traffic can sometimes cause slight delays.

Paper returns take longer to process because they require manual handling. Mailed returns may take several weeks before processing even begins, which pushes refund dates further out.

What Affects Your Refund Amount

Refund totals vary from person to person. The amount you receive depends on your income, how much tax was withheld from your paychecks, and which credits or deductions you claim. Historically, average federal refunds have often ranged between $2,500 and $3,500, but individual amounts can be higher or lower.

Over-withholding during the year, claiming refundable credits, and certain retirement contributions may increase your refund. On the other hand, tax liabilities or reduced credits can lower it.

Common Reasons for Refund Delays

Although many refunds are processed smoothly, some returns require extra review. Errors on a tax return, mismatched income details, missing documents, or identity verification checks can slow processing. Returns claiming certain refundable credits may also face additional review time under federal rules.

How to Track Your Refund

Taxpayers can monitor their refund using the official IRS online tracking tool. For electronic filers, updates typically appear within 24 hours after submission. Paper filers may need to wait about four weeks before tracking information becomes available. Having your Social Security number, filing status, and exact refund amount ready makes the process easier.

Tips for Faster Processing

Filing electronically, carefully reviewing your return for mistakes, and choosing direct deposit are the most effective ways to speed up your refund. Responding quickly to any IRS verification requests also helps avoid unnecessary delays.

In 2026, most electronic filers using direct deposit can expect refunds within about 21 days of acceptance. Filing early and accurately remains the best strategy for receiving your money without delay.

Disclaimer:

Refund timelines and amounts depend on individual filing details and IRS processing conditions. This article provides general information only and should not be considered tax advice. For personalized guidance, consult official IRS resources or a qualified tax professional.